Ky Payroll Calculator

Ky Payroll Calculator - Web use this kentucky gross pay calculator to gross up wages based on net pay. Paycheck calculator calculate tax pay. Depending on the context, it. Paycheck results is your gross pay and specific deductions from your. Enter your info to see your take home pay.

Simply input salary details, benefits and deductions, and any. Web the state income tax rate in kentucky is 5% while federal income tax rates range from 10% to 37% depending on your income. Web smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes. Just enter the wages, tax. What is my gross income? The results are broken up into three sections: Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in kentucky.

kentucky tax calculator Risa Mize

Web federal paycheck calculator photo credit: Web the state income tax rate in kentucky is 5% while federal income tax rates range from 10% to 37% depending on your income. What is my gross income?.

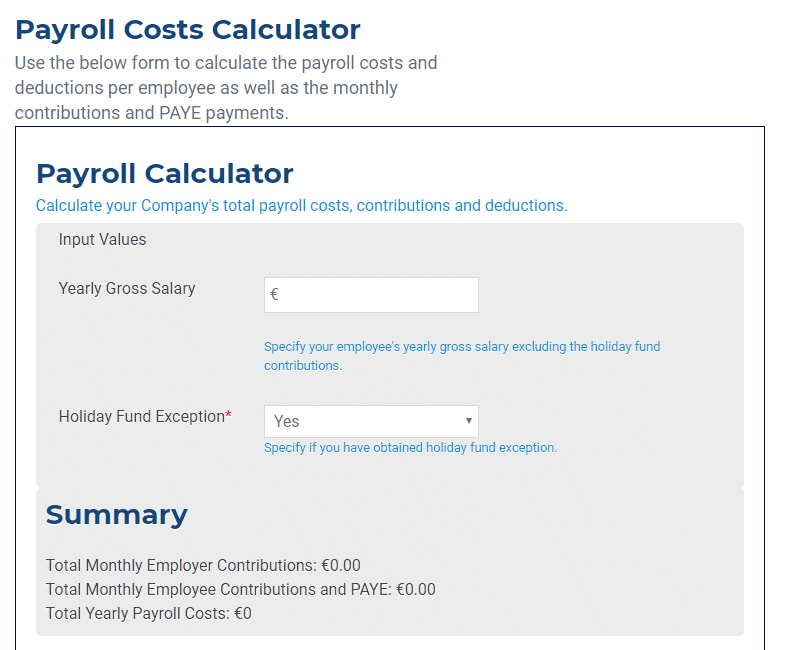

Payroll calculator Evidentrust Financial Services Ltd

Web the state income tax rate in kentucky is 5% while federal income tax rates range from 10% to 37% depending on your income. All you have to do is enter each employee’s wage and.

Kentucky Payroll Calculator 2024 iCalculator™ US

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web federal paycheck calculator photo credit: This paycheck calculator can help. Just enter the wages,.

Kentucky Paycheck Calculator 2023

Web kentucky paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? This paycheck calculator can help. The results are broken up into three.

How to Use a Free Payroll Calculator

Web use the kentucky paycheck calculator to estimate net or “take home” pay for salaried employees. Just enter the wages, tax. Use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either.

State of Kentucky Payroll Calendar 2022 2022 Payroll Calendar

©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web the irs has created a free calculator, called the tax withholding estimator, which can.

Kentucky Paycheck Calculator 2023 2024

Use adp’s kentucky paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal.

Payroll Calculator Free Employee Payroll Template for Excel

Depending on the context, it. Web kentucky paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web to calculate a paycheck start with.

Kentucky Paycheck Calculator 2022 2023

Web federal paycheck calculator photo credit: Web use this kentucky gross pay calculator to gross up wages based on net pay. Enter your info to see your take home pay. This number is the gross.

Kentucky Paycheck Tax Calculator CALCKP

Web we designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Just enter the wages, tax. Web use this kentucky gross pay calculator to gross up wages based on net pay..

Ky Payroll Calculator This number is the gross pay per pay period. Web use the kentucky paycheck calculator to estimate net or “take home” pay for salaried employees. Web smartasset's kentucky paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. We’ll do the math for you—all you.