1031 Exchange Calculation

1031 Exchange Calculation - Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. This must be an investment property—not a primary residence—and it should. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). To pay no tax when executing a 1031 exchange, you must purchase at least as much as you sell (net sale) and you must use all of the cash received (net. For example, let’s say you perform a 1031 exchange by selling a property for $300,000.

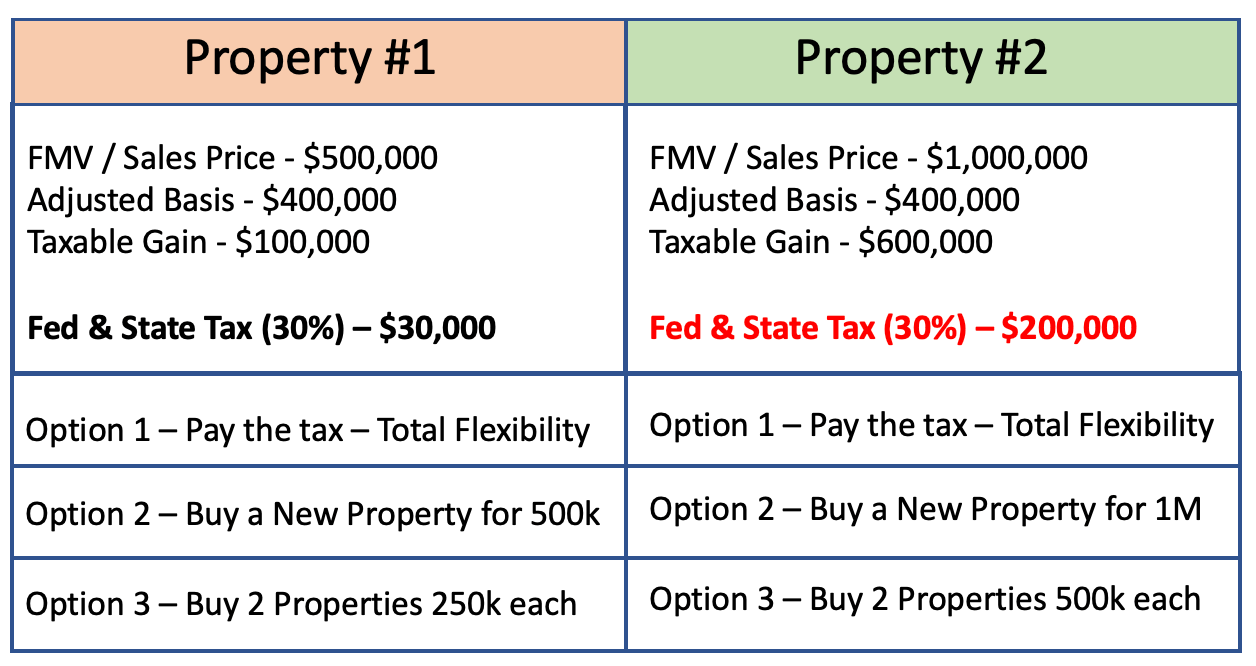

This simplified estimator is for example. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into. Web even though taxes are being deferred, 1031 exchanges must be reported to the irs. To pay no tax when executing a 1031 exchange, you must purchase at least. 1031crowdfunding.com has been visited by 10k+ users in the past month Web the build to suit exchange. This must be an investment property—not a primary residence—and it should.

1031 Exchange Calculation Worksheet

To pay no tax when executing a 1031 exchange, you must purchase at least. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web the build to suit.

What is a 1031 Exchange?

Web 1031 exchange deadline calculator. Federal tax on depreciation recapture: Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

This must be an investment property—not a primary residence—and it should. Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. Web even though taxes are being deferred, 1031.

1031 Exchange Calculator with Answers to 16 FAQs! Internal Revenue

Reverse and improvement exchange parking structures; To pay no tax when executing a 1031 exchange, you must purchase at least. What is a 1031 exchange?. The basics suppose you are a real estate investor. Federal.

How To Do A 1031 Exchange Like A Pro Free Guide

Reverse and improvement exchange parking structures; Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer. Web.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Web this 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. The basics suppose you are a real estate investor. This simplified estimator is for example. Total tax savings resulting.

When and How to use the 1031 Exchange Mark J. Kohler

Meet our teamover 20,000 transactionssubmit a messageover 30 years experience What is a 1031 exchange?. The basics suppose you are a real estate investor. Total tax savings resulting from deferral of. To pay no tax.

1031 Exchange When Selling a Business

Web updated december 20, 2023 reviewed by david kindness fact checked by marcus reeves a 1031 exchange is a swap of one real estate investment property for another that. Identify the property you want to.

The Complete Guide to 1031 Exchange Rules

Total tax savings resulting from deferral of. Web this capital gains tax calculator estimator is provided to illustrate potential taxes to be paid in a taxable sale (versus a 1031 exchange). You choose to sell.

1031 Exchange Full Guide Casaplorer

Web to accomplish a section 1031 exchange, there must be an exchange of properties. Closing date what day will escrow. Web a 1031 exchange is a real estate investing tool that allows investors to exchange.

1031 Exchange Calculation Meet our teamover 20,000 transactionssubmit a messageover 30 years experience Identify the property you want to sell. Property you are selling selling price of property selling. Web follow these steps to do a 1031 exchange: Web 1031 exchange deadline calculator.