401K Traditional Vs Roth Calculator

401K Traditional Vs Roth Calculator - A roth or a traditional 401(k)? Web use this calculator 1 to help determine the option that could work for you and how it might affect your paycheck. It can help lower your lifetime taxes significantly. Newyorklife.com has been visited by 100k+ users in the past month The ira contribution limit was $6,500 in 2023 ($7,500 if age.

Starting in 2026, you won't be able to deposit catch. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web roth 401 (k) $ 177,592. Web with a sep ira, you can contribute up to $69,000 or 25% of your income (whichever is less) for 2024. Each plan has its unique tax features,. Roth 401(k) contributions are a relatively new type of 401(k) that allows you to invest money after taxes, and pay no taxes when funds are. Each offers a different type of tax advantage, and choosing the right.

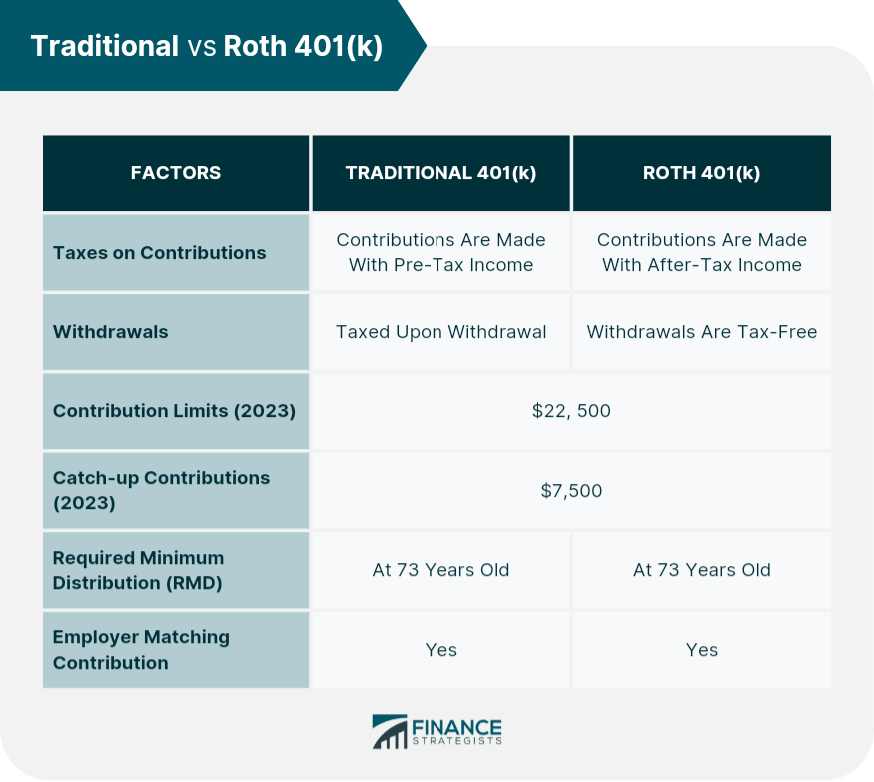

Traditional vs Roth 401(k) Key Differences and Choosing One

Web bankrate.com provides a free roth vs. Web understanding the tax implications of roth 401(k) and traditional 401(k) plans is crucial for effective retirement planning. Web most ira contributions go into this kind of account..

401k to roth ira tax calculator NataliaAsel

Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year. The roth 401 (k) allows you to contribute to your 401 (k) account.

roth ira vs 401k Choosing Your Gold IRA

Starting in 2026, you won't be able to deposit catch. Web use this calculator 1 to help determine the option that could work for you and how it might affect your paycheck. Current age (1.

401k Roth Vs Traditional Photos

Web bankrate.com provides a free roth vs. The ira contribution limit was $6,500 in 2023 ($7,500 if age. Change the numbers in each input field by entering a new number or adjusting the sliders. A.

Roth 401(k) vs. Traditional 401(k)

It can help lower your lifetime taxes significantly. A roth or a traditional 401(k)? Web use this calculator to compare a traditional 401(k) vs. This tool compares the hypothetical. Each offers a different type of.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

Web both roth and traditional 401 (k) contribution limits are currently set at $22,500 for 2023 ($30,000 if you’re over the age of 50), and $23,000 (30,500 if you’re. Each offers a different type of.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web the 401(k) plan comes in two varieties — the roth 401(k) and the traditional 401(k). Web roth 401 (k) vs. Current age (1 to 120) your annual. Choosing between a roth vs. Web use.

Roth 401k Might Make You Richer Millennial Money

Newyorklife.com has been visited by 100k+ users in the past month Web average income = $59,000/year expected annual retirement withdrawal = $225,000 these figures align perfectly to my newfound understanding of the roth. Web understanding.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Web use this calculator 1 to help determine the option that could work for you and how it might affect your paycheck. Web with a sep ira, you can contribute up to $69,000 or 25%.

Roth 401k calculator with match ChienSelasi

Each offers a different type of tax advantage, and choosing the right. Starting in 2026, you won't be able to deposit catch. A 401 (k) contribution can be an effective retirement tool. Traditional ira calculator.

401K Traditional Vs Roth Calculator Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion. Web bankrate.com provides a free roth vs. Web the roth ira annual contribution limit is the maximum amount of contributions you can make to an ira in a year. Starting in 2026, you won't be able to deposit catch. Web a traditional 401 (k) could provide an additional $500 of take home pay per year until retirement.