Expected Return On A Portfolio Calculator

Expected Return On A Portfolio Calculator - In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web return on investment (roi) allows you to measure how much money you can make on a financial investment like a stock, mutual fund, index fund or etf. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. Web now that we have the return and weight of each investment, we need to multiply these numbers. Enter the potential gains and their respective probabilities in the second row.

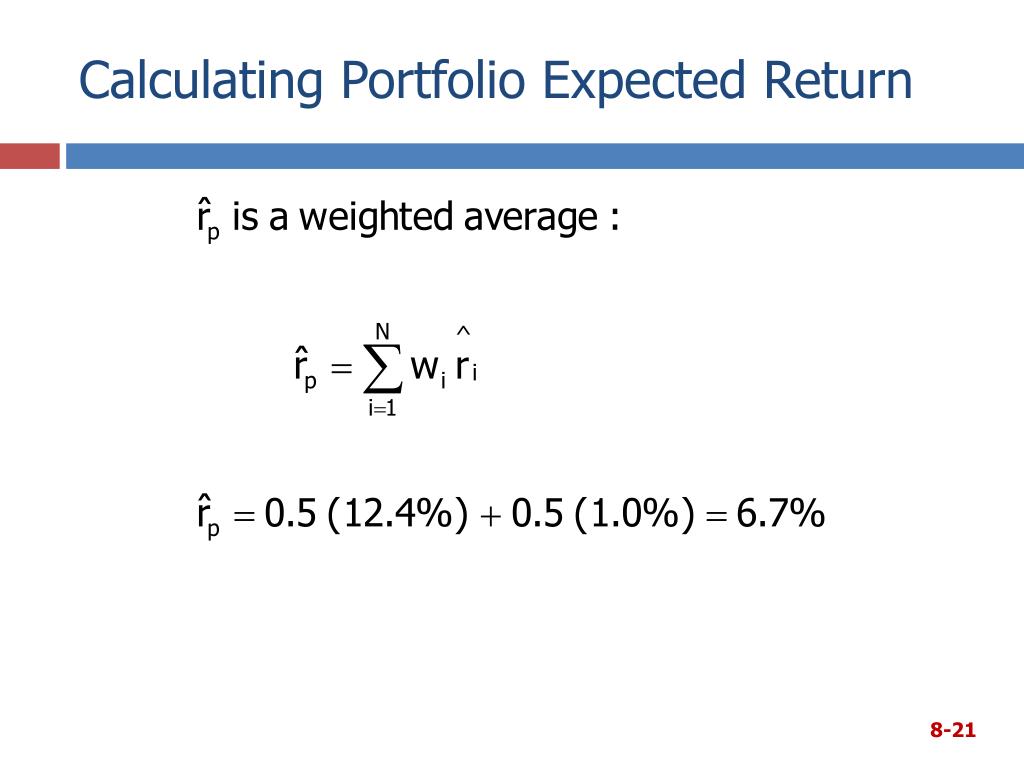

Rp = ∑wi ri where wi is the investment weight. Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight. Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. Web portfolio expected return e (r) = σ r (i) × p (i) where: An expected return is often expressed in. Web key takeaways investors and portfolio managers can calculate the anticipated values of their portfolios by using the expected return and standard.

PPT Risk and Rates of Return PowerPoint Presentation, free download

Web portfolio expected return e (r) = σ r (i) × p (i) where: Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or.

Calculate Risk And Return Of A TwoAsset Portfolio In Excel (Expected

E(r i) is the expected return on. Expected return = (return a x probability a) + (return b x probability b) identify the. Note that the probabilities must sum to 100%. Formally, the expected return.

Portfolio Expected Return Calculator Scaling Partners

Web expected return can be defined as the probable return for a portfolio held by investors based on past returns, or it can also be defined as an expected value of the. E(r i) =.

Expected Return (ER) Of a Portfolio Calculation and Limitations

Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. This expected return calculator is a valuable tool to assess the potential performance of an investment. E(r.

Calculate the portfolios expected return. Theron Group Blog

An expected return is often expressed in. Enter the potential gains and their respective probabilities in the second row. Web you may also find the following calculators useful: Web portfolio expected return e (r) =.

Portfolio Return Formula Calculator (Examples With Excel Template)

Formally, the expected return formula can. Web based on the respective investments in each component asset, the portfolio’s expected return can be calculated as follows: Note that the probabilities must sum to 100%. Expected return.

How to Calculate Portfolio Returns From Scratch (Example Included

Recurring investing · cash management · webull smart advisor Web expected rate of return (err) = r1 x w1 + r2 x w2. Web key takeaways investors and portfolio managers can calculate the anticipated values.

How to Calculate Portfolio Returns From Scratch (Example Included

Rp = ∑wi ri where wi is the investment weight. Web now that we have the return and weight of each investment, we need to multiply these numbers. Web the calculator uses the following formula.

Calculate the portfolio expected return. Theron Group Blog

Based on the probability distribution. Formally, the expected return formula can. Enter the potential gains and their respective probabilities in the second row. Compare ira optionsplan for your retirementimprove how you invest Rp = ∑wi.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

For real estate, we will multiply.56 by 10% to get 5.6%. Web an expected return calculator is a tool that computes the expected return on an investment, considering the probabilities and potential returns of different..

Expected Return On A Portfolio Calculator Σ → summation notation p (i) → probability of outcome r (i) → return in outcome expected return. Web you may also find the following calculators useful: This expected return calculator is a valuable tool to assess the potential performance of an investment. Compare ira optionsplan for your retirementimprove how you invest In this formula, “r” equals rate of return, while “w” is equivalent to the asset weight.