How To Calculate Nj Property Tax

How To Calculate Nj Property Tax - Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its. Intuit.com has been visited by 1m+ users in the past month Standards for valuing property new jersey. Web first, fill in the value for your current nj real estate tax assessment in the field below, then select your county and city, and press the calculate button. Web a town’s general tax rate is calculated by dividing the total dollar amount it needs to raise (by school, county, municipality, etc.) by the total assessed value of all its taxable.

The total amount of property tax to be collected by a town is determined by its county, municipal, and school budget costs. Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at. The state has the highest property taxes in the nation, with an average property tax bill of. Single married/filing joint married/filing separate head of household qualifying widow. Web a town’s general tax rate is calculated by dividing the total dollar amount it needs to raise (by school, county, municipality, etc.) by the total assessed value of all its taxable. Web $ calculate your property tax estimate is: Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873.

33+ how to calculate nj property tax LadyArisandi

Web new jersey’s real property tax is “ad valorem” meaning that each person pays tax based on the value of the property they own. The total amount of property tax to be collected by a.

How to Calculate Property Taxes

The total amount of property tax to be collected by a town is determined by its county, municipal, and school budget costs. Real property tax systems require owners of land and buildings to pay an.

Township of Nutley New Jersey Property Tax Calculator

Enter the assessed value of the property for. Belvidere has the highest property tax rate in warren county with a general tax rate of 5.873. Enter the appropriate amounts for calendar years 2022 and 2023.

33+ how to calculate nj property tax LadyArisandi

Enter the assessed value of the property for. New jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to. Web below is a town by town.

How to Calculate Property Tax Ownerly

Web homeowners in new jersey pay an average of $8,797 in property taxes annually, which equals an effective property tax rate of 2.47%, the highest in the nation. Find the current tax rate for. Determine.

Property Taxes By Town In Nj Property Walls

Determine the assessed value of your property, which is the value assigned to your property by the local tax assessor. Real property tax systems require owners of land and buildings to pay an amount of.

33+ how to calculate nj property tax LadyArisandi

Web use our income tax calculator to find out what your take home pay will be in new jersey for the tax year. Real property tax systems require owners of land and buildings to pay.

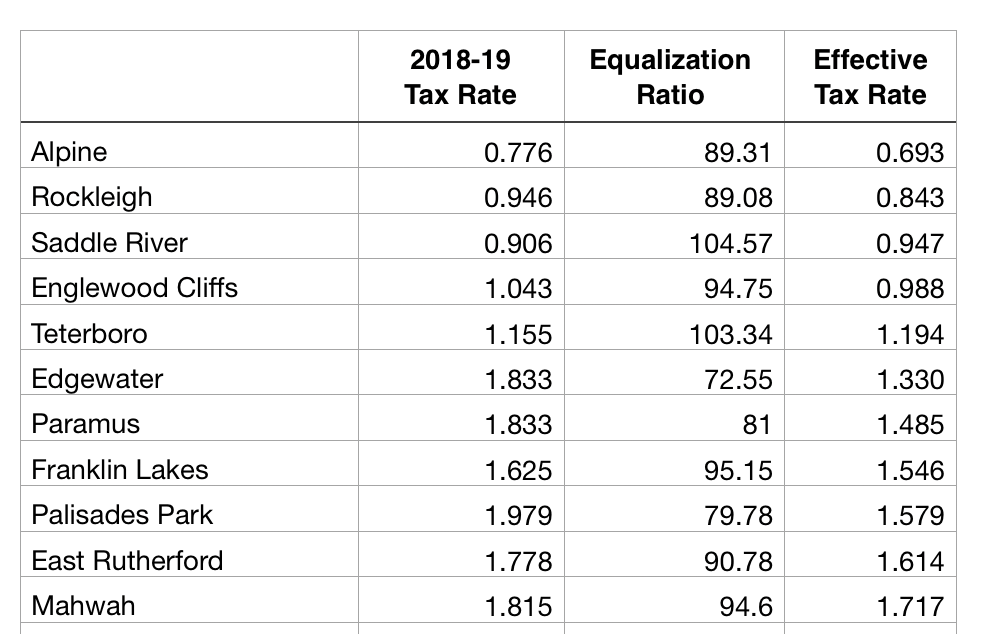

NJ Property Taxes A Primer Actuarial News

The total amount of property tax to be collected by a town is determined by its county, municipal, and school budget costs. Web homeowners in new jersey pay an average of $8,797 in property taxes.

33+ how to calculate nj property tax LadyArisandi

Web use our income tax calculator to find out what your take home pay will be in new jersey for the tax year. New jersey has the highest property taxes in the nation, with an.

33+ how to calculate nj property tax LadyArisandi

Web karin price mueller | nj advance media for nj.com. Local governments often determine and charge property tax. Intuit.com has been visited by 1m+ users in the past month Our new jersey property tax calculator.

How To Calculate Nj Property Tax Web if you lived in more than one new jersey residence during the year, you must determine the total amount of property taxes (and/or 18% of rent) to use when. County, municipal and school budget costs determine the amount of property tax to be collected. Find the current tax rate for. Enter the assessed value of the property for. Zillow has 17 photos of this $190,000 3 beds, 1 bath, 1,366 square feet single family home located at.

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)