Ira Conversion Tax Calculator

Ira Conversion Tax Calculator - Web ira conversion calculator — simply visual. Web this calculator compares the estimated future value of traditional ira assets with the estimated future value of those assets after being converted to a roth ira. Commissions do not affect our editors' opinions or evaluations. Web the ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings. Web for 2024, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older.

Prior to that time, in. Web 1 eligibility and contribution limits 2 growth potential enter your information to determine how much you are eligible to contribute to each type of ira, enter the following. Web amount to convert from a traditional ira account to a roth ira. As a result, you’re better off moving the smallest amount. Jul 21, 2022, 3:56pm editorial note: Web convert ira to roth calculator calculate your earnings and more in 1997, the roth ira was introduced. It also allows you to compare the impact of future.

Roth IRA Calculator Roth ira calculator, Roth ira, Traditional ira

Web roth ira conversion calculator if you already have a traditional ira, you may be considering whether to convert it to a roth ira. Web roth ira conversion calculator see whether converting your traditional ira.

How To Estimate Tax Liability On IRA Conversions

Custom tools & strategiesexplore various annuities Web when you make a roth ira conversion, you increase your taxable income by the entire amount converted. Since then, many people have converted all or a portion of.

How to Use a Roth IRA Calculator Ready to Roth

Web key takeaways you can shift money from a traditional ira or 401 (k) into a roth ira by doing a roth ira conversion. Jul 21, 2022, 3:56pm editorial note: One big decision is whether.

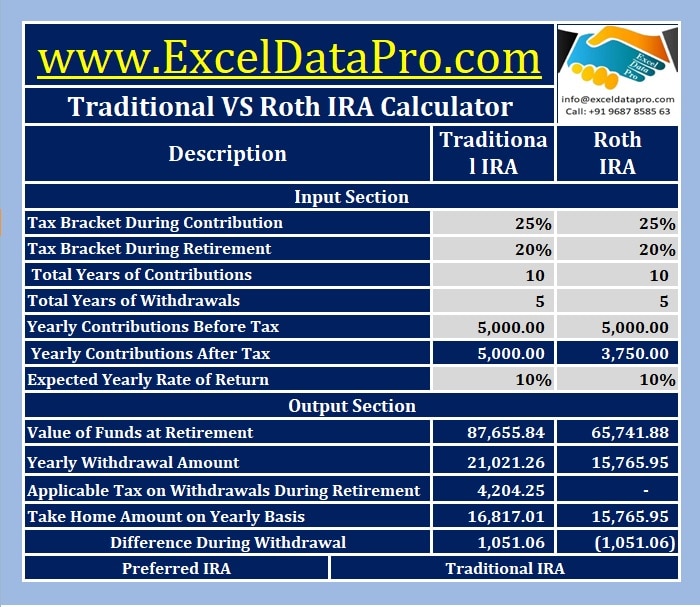

Download Traditional VS Roth IRA Calculator in Excel ExcelDataPro

Web amount to convert from a traditional ira account to a roth ira. See an estimate of the taxes. Custom tools & strategiesexplore various annuities Use this roth conversion calculator to understand the tax implications.

401k vs roth ira calculator Choosing Your Gold IRA

We earn a commission from partner links on forbes advisor. As a result, you’re better off moving the smallest amount. Web when you make a roth ira conversion, you increase your taxable income by the.

fidelity roth ira calculator Choosing Your Gold IRA

What is your current plan balance? Jul 21, 2022, 3:56pm editorial note: As a result, you’re better off moving the smallest amount. An ameriprise financial advisor can help you evaluate. Commissions do not affect our.

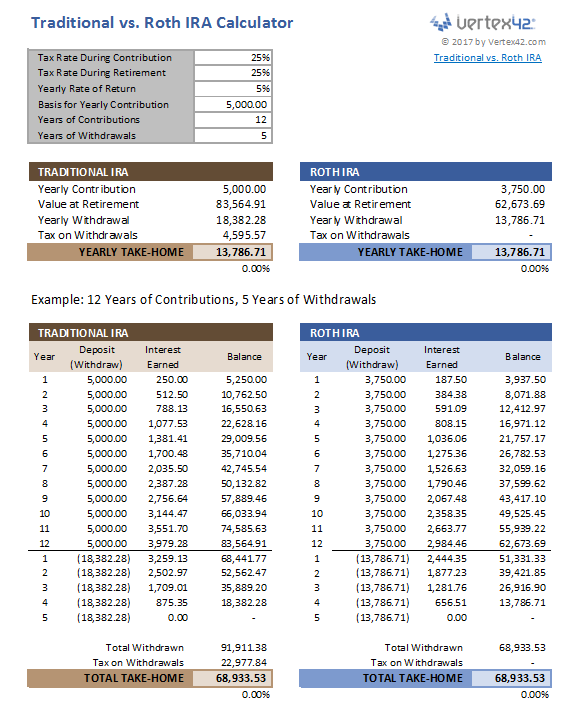

Roth IRA Conversion Calculator Excel

Web ira to roth conversion calculator when planning for retirement, there are a number of key decisions to make. Web ira conversion calculator — simply visual. Web roth ira conversion calculator if you already have.

Roth IRA Conversion Spreadsheet Seeking Alpha

One big decision is whether or not you should convert your. The amount you convert is added to your. As a result, you’re better off moving the smallest amount. Web roth ira conversion calculator see.

A Strategy for Your IRA in 2020 Roth Conversion

Jul 21, 2022, 3:56pm editorial note: For example, if you move $100,000 into a roth 401 (k) and you're in the 22% tax bracket, you'll owe $22,000 in. Web roth ira conversion calculator is converting.

Roth IRA Conversion Tax Calculator Software

Web for 2024, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older. Web try our roth conversion calculator to compare your tax bite today on different.

Ira Conversion Tax Calculator Web ira to roth conversion calculator when planning for retirement, there are a number of key decisions to make. Periodically converting a portion of your retirement savings into roth assets can give you. Web try our roth conversion calculator to compare your tax bite today on different conversion amounts vs. Web 2023 roth conversion calculator. Web roth ira conversion calculator see whether converting your traditional ira to a roth ira may be beneficial to you.