New Jersey Property Tax Calculator

New Jersey Property Tax Calculator - December 5, 2023 list and map of property tax rates for all nj municipalities how are nj property taxes calculated? Web estimate my new jersey property tax. Web state of new jersey > government > nj taxes. Web this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. Enter your info to see your take home pay.

The realty transfer fee is imposed upon the recording of deeds evidencing transfers of title to real property in the state of new jersey. Web a town's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet local budget expenses by the total assessed value of all its. It will likely be listed as a line item on. December 5, 2023 list and map of property tax rates for all nj municipalities how are nj property taxes calculated? Web calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Web estimate my new jersey property tax. Web click here to view.

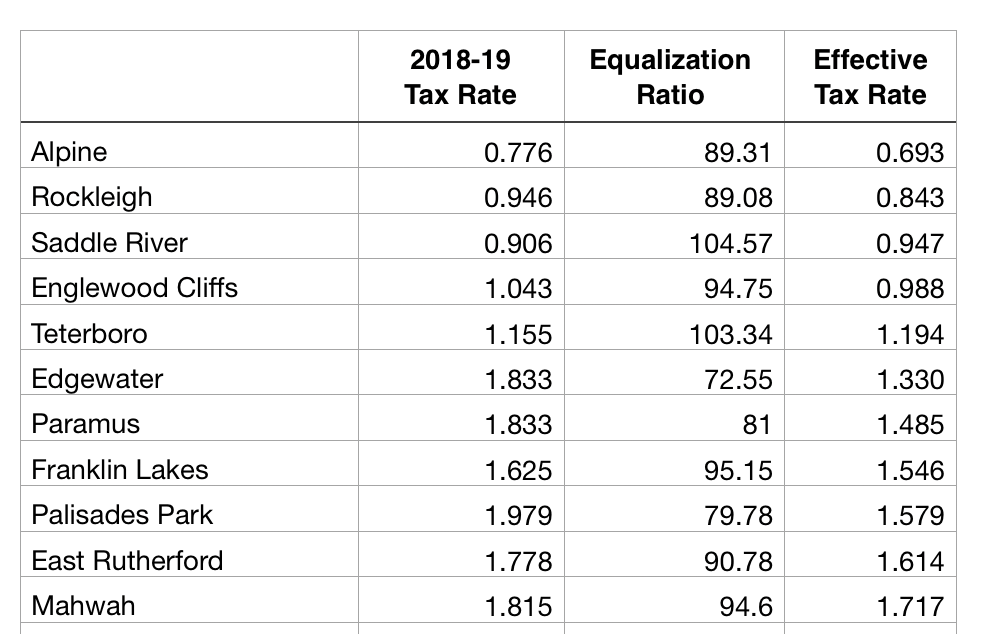

Average NJ property tax bill near 9,300 Check your town here

Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data. December 5, 2023 list and map of property tax rates for all.

Property Taxes By Town In Nj Property Walls

Enter your info to see your take home pay. Web property taxes in nj is calculated using the formula: Web homeowners in new jersey pay an average of $8,797 in property taxes annually, which equals.

Fair Property Taxes for All NJ Launches New “Property Tax Viewer

The state of nj site may contain optional links, information, services and/or content from other websites operated by third parties. Web real estate transfer &mansion tax. Assessed value x (general tax rate/100)= property tax. Our.

33+ how to calculate nj property tax LadyArisandi

Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data. Find the current tax rate for. Web this calculator provides an estimate.

33+ how to calculate nj property tax LadyArisandi

Web a single new jerseyite will have an income tax bill of $19,236.55. Our new jersey property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web the.

Fast Facts New Jersey’s Average Home Values Are Well Below Estate Tax

Assessed value x (general tax rate/100)= property tax. Web look at your current mortgage statement and determine if your new jersey real property taxes are paid as part of your monthly mortgage. Our new jersey.

New Jersey Mortgage Calculator with taxes and insurance

Atlantic county property taxes below is a town by town list. Web look at your current mortgage statement and determine if your new jersey real property taxes are paid as part of your monthly mortgage..

33+ how to calculate nj property tax LadyArisandi

December 5, 2023 list and map of property tax rates for all nj municipalities how are nj property taxes calculated? Web estimate my new jersey property tax. Press calculate to see the average property tax..

33+ how to calculate nj property tax LadyArisandi

Enter your 2022 and 2023 property assessment values in each box below and then hit calculate to see the year's difference in your individual. The state of nj site may contain optional links, information, services.

Township of Nutley New Jersey Property Tax Calculator

Web nj transfer tax calculator customarily the new jersey transfer tax is paid by the seller and the mansion tax on residential or commercial purchases of $1 million or more is. Web smartasset's new jersey.

New Jersey Property Tax Calculator Residents clamor for relief every year so they. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Compare your rate to the new jersey and u.s. The state of nj site may contain optional links, information, services and/or content from other websites operated by third parties. Web new jersey has the highest property taxes in the nation, with an average bill of $9,490 in 2022, according to state data.