Roth 401K Vs Traditional 401 K Calculator

Roth 401K Vs Traditional 401 K Calculator - Web roth 401 (k) vs traditional 401 (k) calculator find out which kind of 401 (k) is best for you updated february, 2024 roth vs. It can help lower your lifetime taxes significantly. Newyorklife.com has been visited by 100k+ users in the past month Web use this calculator to compare a traditional 401 (k) vs. Web roth vs traditional 401 (k) and your paycheck calculator use the calculator below to help determine which option will be best and how it might affect your paycheck.

As of january 2006, there is a new type of 401. Web roth vs traditional 401 (k) and your paycheck calculator use the calculator below to help determine which option will be best and how it might affect your paycheck. Change the numbers in each input field by entering a new number or adjusting the sliders. Web roth 401 (k) contributions are a relatively new type of 401 (k) that allows you to invest money after taxes, and pay no taxes when funds are withdrawn later — for many. Roth 401 (k) $ 208,932. Web a 401 (k) contribution can be an effective retirement tool. The roth 401(k) allows you to contribute.

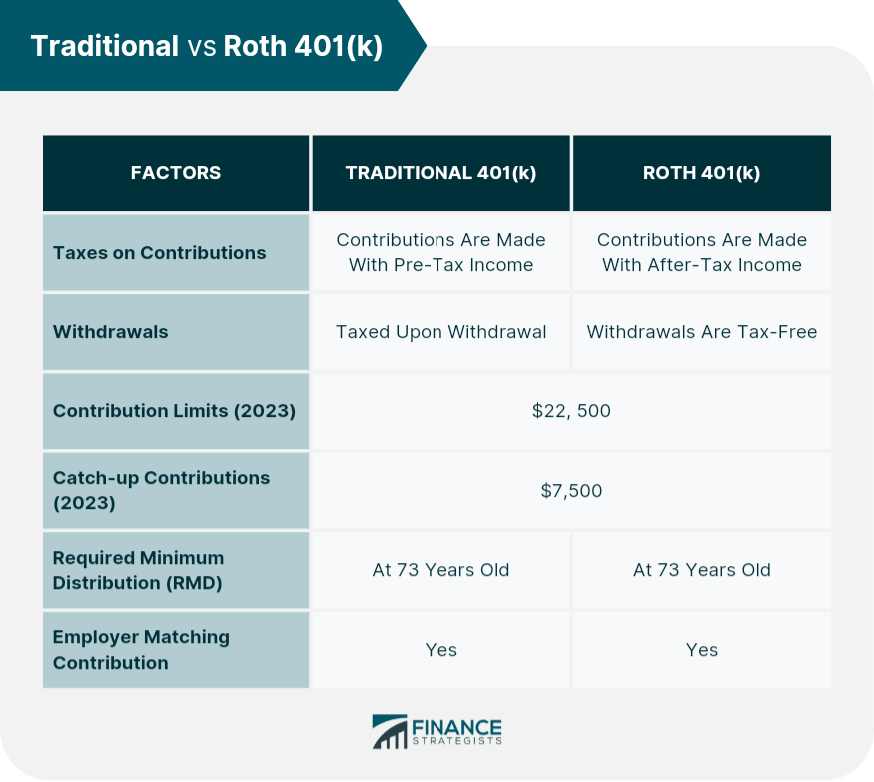

The Differences Between a Roth 401(k) and a Traditional 401(k)

The roth 401(k) allows you to contribute. A 401k contribution can be an effective retirement tool. Use this calculator to help determine if. Web what our roth 401k vs traditional 401k calculator will do for.

Roth 401k Might Make You Richer Millennial Money

(csia) is an affiliate of charles schwab & co., inc. Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024 contribution limit and employer match, then estimates what your 401 (k) balance will be at.

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

The roth 401(k) allows you to contribute to your 401(k) account on an. Web roth 401 (k) vs traditional 401 (k) calculator. Web roth 401 (k) vs. As of january 2006, there is a new.

IRA vs 401(k) and Roth vs traditional Personal Finance Club

As one of the best retirement plans, 401(k)s allow employers to. Web roth vs traditional 401 (k) calculator which account type is right for me? Web nerdwallet’s free 401 (k) retirement calculator calculates your 2024.

Traditional vs Roth 401(k) Key Differences and Choosing One

Web a 401(k) contribution can be an effective retirement tool. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web roth vs traditional 401 (k) and your.

Traditional 401k to roth 401k conversion tax calculator SunniaHavin

Web a 401(k) contribution can be an effective retirement tool. Web the contribution limits on a roth 401(k) are the same as those for a traditional 401(k): Web nerdwallet’s free 401 (k) retirement calculator calculates.

401(k) vs Roth 401(k) How Do You Decide? Ellevest

Web roth 401 (k) contributions are a relatively new type of 401 (k) that allows you to invest money after taxes, and pay no taxes when funds are withdrawn later — for many. Web roth.

Roth 401k Vs Traditional 401 K Which Is Better Robotandro

Use this calculator to help determine if. Web a 401 (k) contribution can be an effective retirement tool. Web roth 401 (k) vs traditional 401 (k) calculator. It can help lower your lifetime taxes significantly..

Roth 401(k) Vs. Traditional 401(k) And What Is The Best Option

Traditional 401 (k) and your paycheck a 401 (k). It can help lower your lifetime taxes significantly. Web there are multiple types of 401(k) plans, including a traditional, roth, or solo 401(k) plan. The roth.

Traditional 401(k) vs. Roth How to Decide — Millennial Money with Katie

Newyorklife.com has been visited by 100k+ users in the past month A 401(k) contribution can be an effective retirement tool. Change the numbers in each input field by entering a new number or adjusting the.

Roth 401K Vs Traditional 401 K Calculator Schwab etfs are distributed by sei investments. Web with a roth employer contribution, the company (your business) takes a deduction as an employee benefit expense for making the contribution to your 401k. Web income tax bracket (accumulation phase) (0% to 75%) taxation of contribution options. Web roth 401 (k) $ 177,592. Web when you convert money to a roth ira, you will need to pay income taxes on the entire amount in the tax year that you make the conversion.