Tax Backwards Calculator

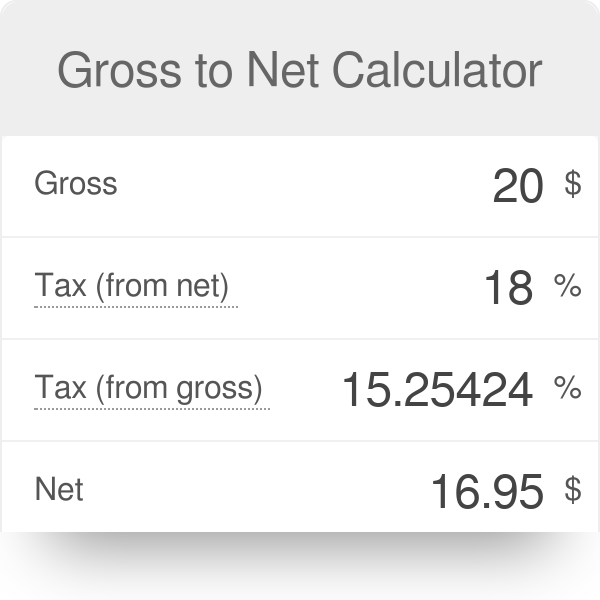

Tax Backwards Calculator - Web how 2024 sales taxes are calculated in ohio. Breaking down the gross price can be a complex task, but tools like the reverse sales tax calculator by calcopolis can help. You can calculate the gross price based on the net price and the tax rate. Divide your sales receipts by 1 plus the sales tax. Sales tax = (total price * sales tax rate) / 100;

Amount with taxes + canada province hst/qst/pst ( variable. Plug in your expected income, deductions and credits, and the calculator will quickly. Just under 3.3 million federal taxpayers used free file in fiscal year 2022. Web the qualified dividend tax rate rises to 15% for the next tax brackets: Web the reverse sale tax will be calculated as following: But if your income remains at $45,000 in 2024, you'll drop. In 2023, the tax brackets were adjusted upward by about 7% to account for last year's high.

Reverse Sales Tax Calculator

Web to calculate the sales tax and total cost, the reverse sales tax calculator uses the following formula: Fast and easy sales tax tool for businesses and people. Also, check the sales tax rates in.

Learn How to Calculate Tax Backwards Save Your Business Tax

Plug in your expected income, deductions and credits, and the calculator will quickly. Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are.

Sales Tax Calculator With Reverse Tax Calculation App Reviews User

The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the. Breakdown of sales taxes for ontario, quebec, bc, alberta, saskatchewan,.

Reverse Tax Calculator For Bc TAXIRIN

Web reverse sales tax calculation. Divide the tax amount by the net price. Web the irs has adjusted its tax brackets for inflation for both 2023 and 2024. But if your income remains at $45,000.

reverse tax calculator uk Majesty Blogosphere Picture Library

Divide the tax amount by the net price. Web how do i calculate sales tax backwards from the total? The first script calculates the sales tax of an item or group of items, then displays.

Reverse HST, harmonized sales tax reverse calculator of 2016

Web the reverse sales tax calculator calculates the original price of a product or service before sales taxes are added. Web the irs has created a free calculator, called the tax withholding estimator, which can.

Tax Reverse Calculator Tax Reverse Calculation

Web formula to calculate sales tax backwards from total. The state general sales tax rate of ohio is 5.75%. In this formula, we assume that you already know the sales tax percentage. But 102 million.

Reverse tax calculator SahbazMaysam

Web the reverse sales tax calculator calculates the original price of a product or service before sales taxes are added. Net sale amount = total sale / (1+ sale tax rate) = 105,000 /1.05 =.

Sales Tax Calculator with Reverse Tax Calculation Tax Me Pro for

You can calculate the gross price based on the net price and the tax rate. + $ 93.75 total price with tax: Amount with taxes + canada province hst/qst/pst ( variable. The first script calculates.

Reverse tax calculator SahbazMaysam

Web the irs has created a free calculator, called the tax withholding estimator, which can help you figure out if you are withholding too much—or too little—from your. Fast and easy sales tax tool for.

Tax Backwards Calculator Also, check the sales tax rates in different states of the u.s. Web it helps you to calculate reverse sales tax. Sales tax = (total price * sales tax rate) / 100; Divide your sales receipts by 1 plus the sales tax. Web a reverse sales tax calculator would quickly show that the original price was $500, and $50 was paid as tax.