Tennesee Paycheck Calculator

Tennesee Paycheck Calculator - Tennessee payroll taxes paying payroll taxes using a payroll tax service use tennessee. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. Web tennessee hourly paycheck calculator take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local. Free tool to calculate your hourly and salary income.

Web tennessee (tn) state payroll taxes in 2024 tennessee’s income tax is simple with a flat rate of 0%. Tennessee payroll taxes paying payroll taxes using a payroll tax service use tennessee. Web to use our tennessee salary tax calculator, all you need to do is enter the necessary details and click on the calculate button. Web federal paycheck calculator photo credit: Updated on dec 05 2023. Year month biweekly week day hour results income. File taxesrun payrollaccounting toolstax deductions

19+ Tn Paycheck Calculator XenoYazdan

For the calendar year 2023, tennessee unemployment. Hourly and salary tennessee, the 16th most populous but the 36th largest state, located in the southeastern region of the united. After a few seconds, you will be.

How to Do Payroll in Tennessee What Every Employer Needs to Know

Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in tennessee. You can also access historic tax. Web how to calculate annual.

Tennessee Paycheck Calculator (Updated for 2023)

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Web tennessee hourly paycheck calculator take home pay is calculated based on up to six.

Gs Pay Scale 2021 Tennessee GS Pay Scale 2022/2023

Web below are your tennessee salary paycheck results. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web federal paycheck calculator photo credit: Paycheck results.

Free Tennessee Paycheck Calculator 2023 TN Paycheck Calculator

Year month biweekly week day hour results income. Use icalculator™ us's paycheck calculator tailored for tennessee to determine your net income per paycheck. File taxesrun payrollaccounting toolstax deductions Web salary paycheck calculator guide tennessee: This.

How to Do Payroll in Tennessee What Every Employer Needs to Know

Web salary paycheck calculator guide tennessee: This applies to various salary. Web tennessee paycheck calculator last reviewed on january 28, 2024 optional criteria see values per: Tax complianceonline access anywhereunlimited payroll runsideal for businesses Use.

How much money comes out for taxes in Tennessee? r/Money

Year month biweekly week day hour results income. Web salary paycheck calculator guide tennessee: Web to use our tennessee salary tax calculator, all you need to do is enter the necessary details and click on.

New tax law takehome pay calculator for 75,000 salary Business Insider

Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an.

Tennessee Payroll Tax Registration · RemoteTeam

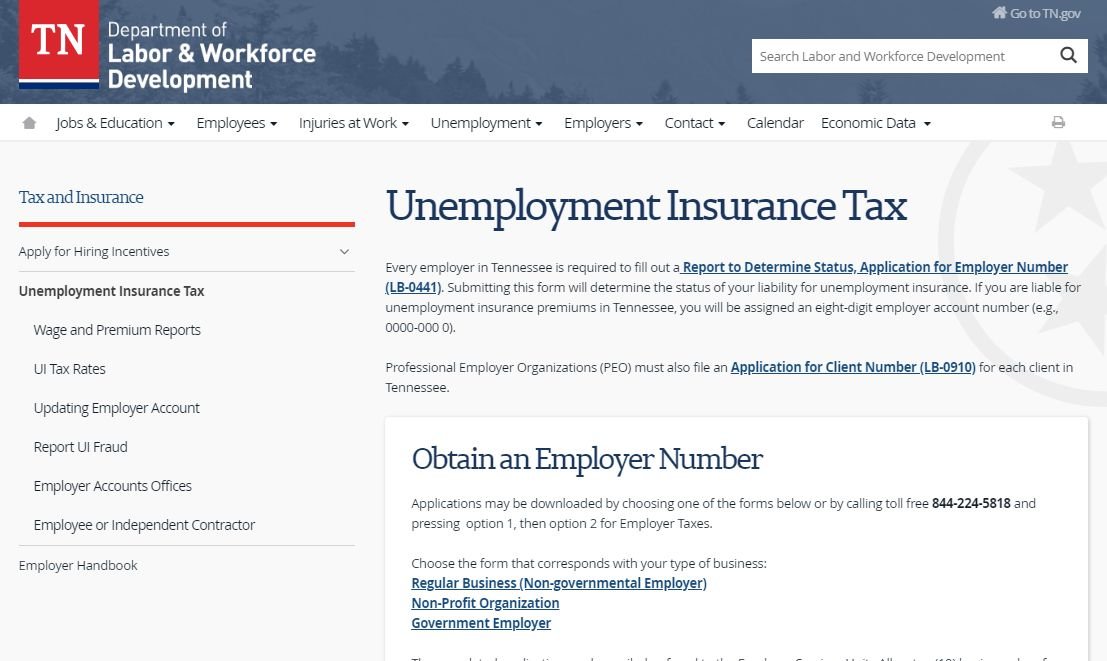

Tax complianceonline access anywhereunlimited payroll runsideal for businesses Paycheck results is your gross pay and specific deductions from your. For the calendar year 2023, tennessee unemployment. How your tennessee paycheck works in. Web how to.

Tennessee Paycheck Calculator Paycheck, Calculator, Finance

Web salary paycheck calculator guide tennessee: How your tennessee paycheck works in. The results are broken up into three sections: Simply enter their federal and state. Tax complianceonline access anywhereunlimited payroll runsideal for businesses

Tennesee Paycheck Calculator Use adp’s tennessee paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. We’ll do the math for you—all you. Web salary paycheck calculator guide tennessee: