Tn Paycheck Tax Calculator

Tn Paycheck Tax Calculator - Just enter the wages, tax withholdings and other. Web tennessee paycheck calculator last reviewed on january 28, 2024 optional criteria see values per: That means that your net pay will be $45,925 per year, or $3,827 per. Web tennessee salary tax calculator for the tax year 2023/24. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent).

Web use adp’s tennessee paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Simply enter their federal and state. ©istock.com/ryanjlane federal paycheck quick facts federal income tax rates range from 10% up to a top marginal rate of 37%. For the calendar year 2023, tennessee unemployment. Web the information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for tennessee residents only. Audit support guaranteeexpense estimatormaximum refund guaranteed Web tennessee paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck?

Tennessee state tax Fill out & sign online DocHub

Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. The new jersey child tax credit program gives families with an income of $30,000 or less a refundable.

How to Calculate Payroll Taxes Workful

Web salary paycheck calculator guide tennessee: Web tennessee paycheck calculator last reviewed on january 28, 2024 optional criteria see values per: Web tennessee (tn) state payroll taxes in 2024. ©istock.com/ryanjlane federal paycheck quick facts federal.

18+ Paycheck Tax Calculator Tn

7.65% total tax 92.35% net pay. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. Web this means that the tennessee tax rate for income is zero..

19+ Tn Paycheck Calculator XenoYazdan

Web tennessee (tn) state payroll taxes in 2024. Web tennessee paycheck calculator last reviewed on january 28, 2024 optional criteria see values per: Web tennessee paycheck calculator for salary & hourly payment 2023 curious to.

Tennessee State Tax Tables 2023 US iCalculator™

If you make $55,000 a year living in the region of tennessee, usa, you will be taxed $9,076. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes..

Free Tennessee Paycheck Calculator 2023 TN Paycheck Calculator

Web use our income tax calculator to find out what your take home pay will be in tennessee for the tax year. You can also access historic tax. However, it does have a tax rate.

How to Do Payroll in Tennessee What Every Employer Needs to Know

Web federal paycheck calculator photo credit: The easy way to calculate your take. Web use adp’s tennessee paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees. Web tennessee salary.

New tax law takehome pay calculator for 75,000 salary Business Insider

Tennessee’s income tax is simple with a flat rate of 0%. Web tennessee paycheck calculator for salary & hourly payment 2023 curious to know how much taxes and other deductions will reduce your paycheck? Web.

Tennessee Paycheck Calculator Paycheck, Calculator, Finance

Calculate your net salary jose january 9, 2024 · 7 min read legal & finance calculate your paycheck in 7. Simply enter their federal and state. Updated on dec 05 2023. Web salary paycheck calculator.

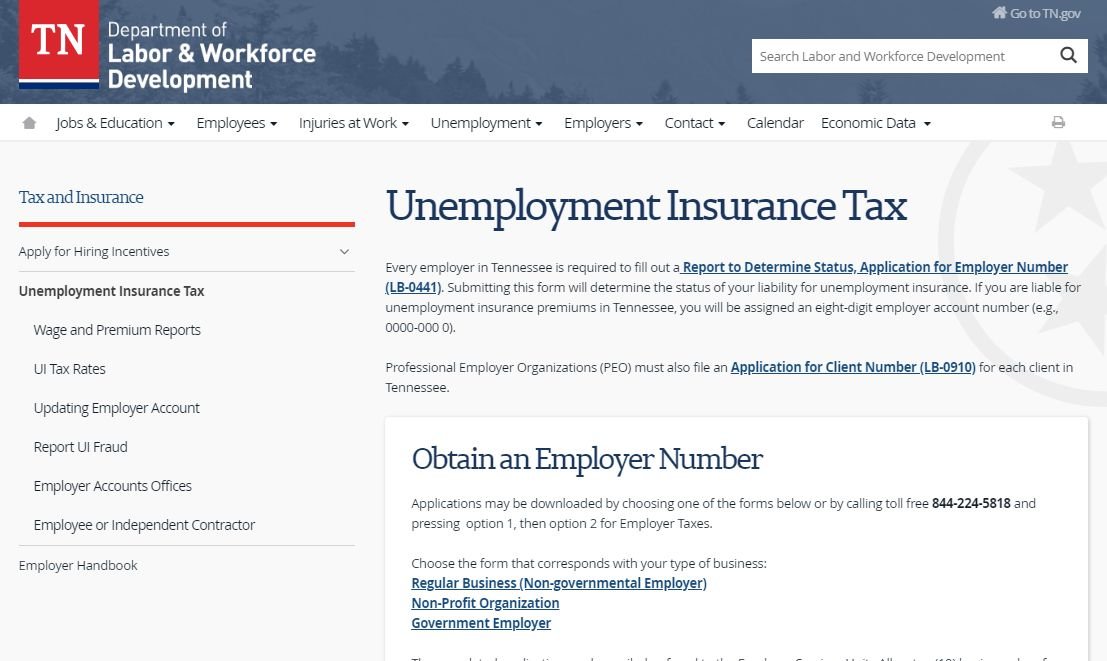

Tennessee Payroll Tax Registration · RemoteTeam

Web tennessee salary tax calculator for the tax year 2023/24. Web smartasset's tennessee paycheck calculator shows your hourly and salary income after federal, state and local taxes. You can also access historic tax. Calculate your.

Tn Paycheck Tax Calculator The tn tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.). Free tool to calculate your hourly and salary income. Web rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent), washington (9.38 percent), and alabama (9.29 percent). Simply enter their federal and state. Web this means that the tennessee tax rate for income is zero.

/cdn.vox-cdn.com/uploads/chorus_image/image/57589909/cardinalspayroll111417.0.png)